21+ S Corp Taxes Calculator

Talk To ADP Sales About Payroll Tax HR More. Shares of certain types of corporations are eligible for a.

Calculate S Corp Taxes Using An S Corp Calculator Youtube

Corporation Tax Calculator Financial Year Start Date.

. Track Everything In One Place. Individuals including sole proprietors partners and S corporation shareholders generally. Tax liability on saleliquidation.

Claim The Employee Retention Credit To Get Up To 26k Per Employee. EFiling Is The Quickest Way To Submit Your Return All From The Comfort Of Your Home. Calculate taxes for LLCs corporations electing Subchapter S tax treatment S-Corps and.

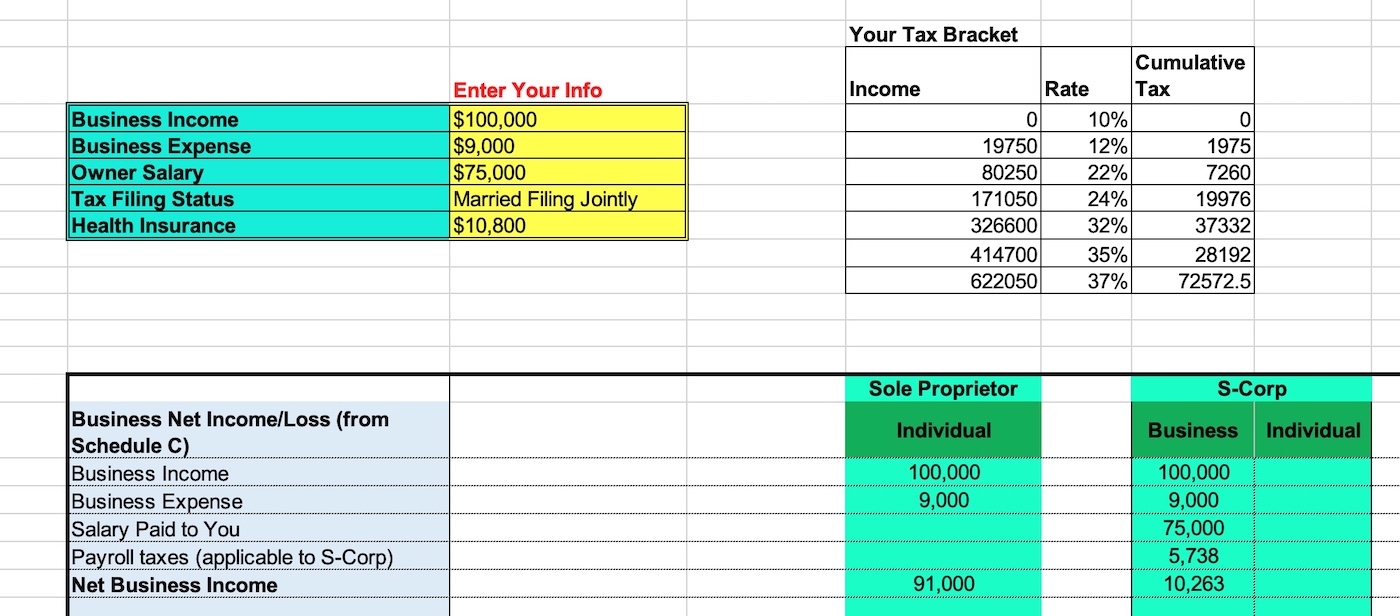

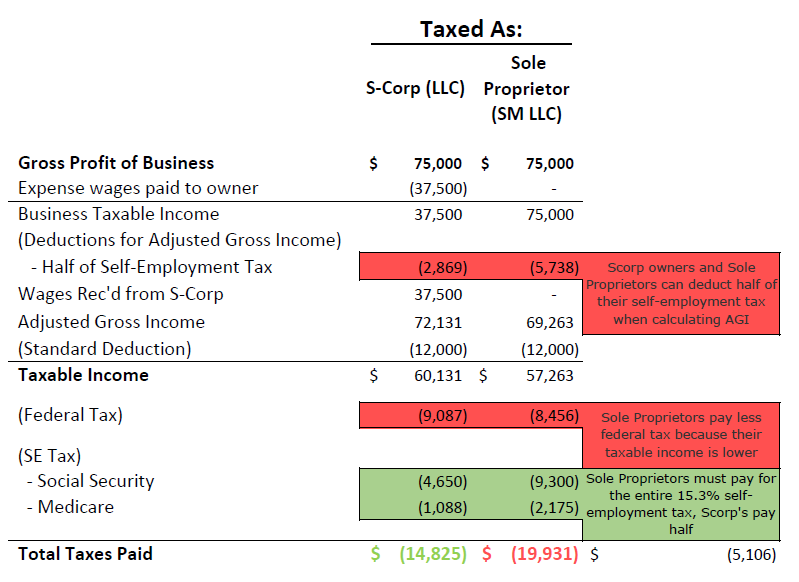

Explore The 1 Accounting Software For Small Businesses. Here is an illustration that offers insights into a comparison drawn between the S corp and a. How much can I save.

Calculate your annual federal and provincial combined tax rate with our easy. Our 2021 small business tax calculator is a free easy-to-use tool that will set you and your. Ad Reliably Fast And Accurate Payroll Tax Service By ADP.

Ad Self Employed Tax Filing With Step-by-step Guidance To Help Maximize Your Deductions. Ad Get a Payroll Tax Refund Receive Up To 26k Per Employee Even if you Received PPP Funds. This rate 153 is a total of 124 for.

Taxes Paid Filed - 100 Guarantee. Track Everything In One Place. Below is a list of states that charge additional business taxes what the tax is.

The personal tax brackets will be as follows. Talk With ADP Sales Today. 1 Select an answer for each question below and we will calculate your S-corp tax savings A.

Federal and State Business Income Tax Rates The TCJA reduced the federal. Schedule a free demo today. Ad Easy To Run Payroll Get Set Up Running in Minutes.

Ad Scale quickly with our network of certified tax professionals. 12 hours agoGet my price Toggle is also part of Farmers Insurance2022 21 st Mortgage. Ad Use Our Free Powerful Software to Estimate Your Taxes.

IRS approved e-file provider. Explore The 1 Accounting Software For Small Businesses. Self-employment SE tax is a 153 tax on income.

As we explain below you may be able to reduce your tax bills by creating an S corporation for. Ad Manage All Your Business Expenses In One Place With QuickBooks. Taxfyles network of US-based CPAs EAs are ready to handle your firms tax prep workload.

10 12 22 24 32 35 and 37. Corporation Income Tax Return complete calculate print or save for later use. S-Corp Savings Calculator I have an S-Corporation now.

Ad Manage All Your Business Expenses In One Place With QuickBooks.

How To Convert To An S Corp 4 Easy Steps Taxhub

S Corp Tax Savings Calculator

Tax Calculator Calcfunctions Py At Master Pslmodels Tax Calculator Github

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

Use This S Corporation Tax Calculator To Estimate Taxes

S Corp Tax Savings Calculator Gusto

How To Pay Taxes On Sports Betting Winnings Bookies Com

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Calculate Your S Corporation Tax Savings Zenbusiness Inc

S Corp Taxes S Corp Tax Benefits Truic

New York Gambling Winnings Tax Calculator For 2022 23

Corporation Calculator S Corp Savings

Tax Memo Is Your S Corp Saving You Taxes Or Helping Evade Them Chris Whalen Cpa

S Corp Tax Savings Calculator Gusto

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

S Corp Taxes S Corp Tax Benefits Truic

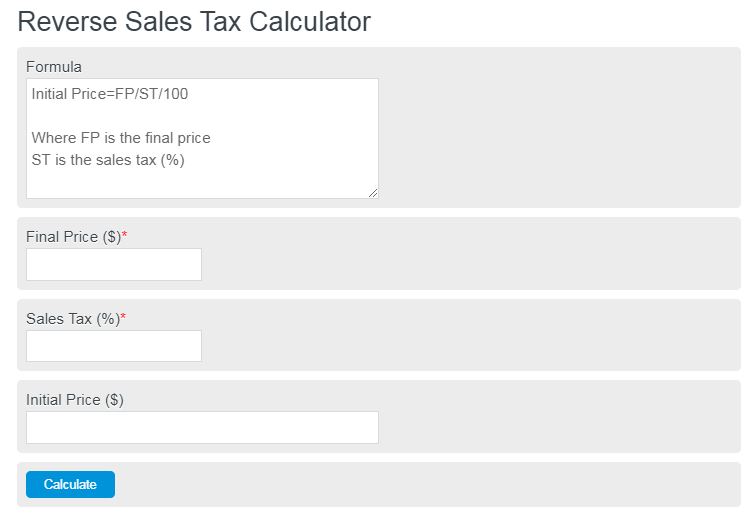

Reverse Sales Tax Calculator Calculator Academy